GMV offers insights into the total value of transactions over a given period, making it a valuable metric for assessing market trends and business growth.

However, it is crucial to differentiate GMV from related metrics like revenue, gross order value, and customer transaction value to gain a complete financial picture.

Key Takeaways:

- GMV reflects the total value of transactions but does not account for deductions like returns, taxes, or discounts.

- Revenue, in contrast, represents the actual income a business earns after such deductions.

- The tax take rate on GMV-derived revenue varies based on business models and regional regulations.

- Platforms like Amazon, eBay, and TikTok each use GMV to measure their market performance in distinct ways, highlighting its adaptability across industries.

- GMV can reveal market trends and customer activity, while revenue is crucial for profitability analysis.

- Recognizing the differences between gross and net revenue is critical for accurate financial reporting.

- GMV does not equate to sales volume, profit, or turnover, emphasizing the need to analyze it alongside other financial metrics.

Let’s explore the nuances of GMV, its calculation, and its relationship to other financial metrics to better understand what these numbers tell us about business performance.

Understanding GMV (Gross Merchandise Value)

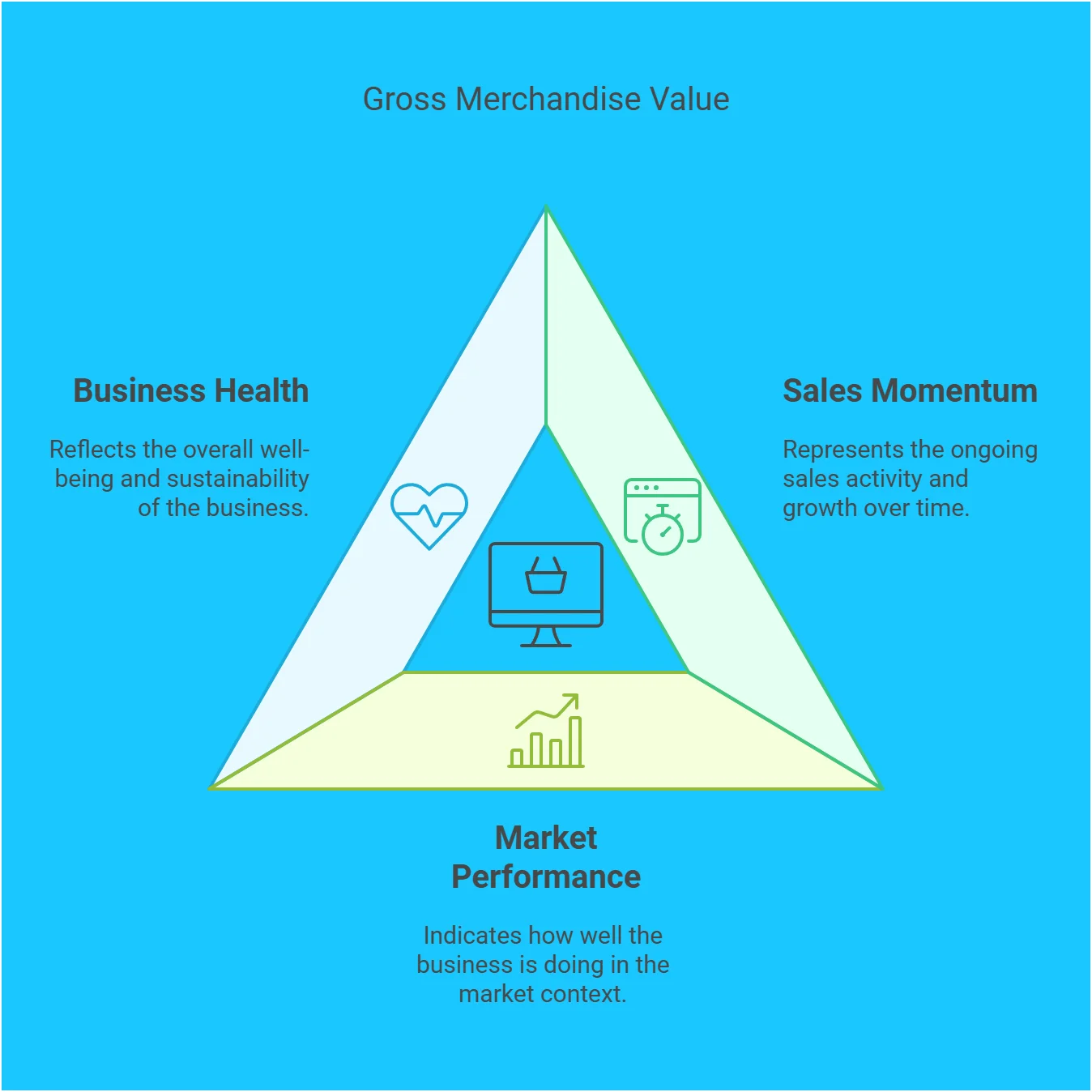

Gross Merchandise Value (GMV) is a foundational metric for many ecommerce businesses. It provides a snapshot of the total value of transactions on a platform, allowing companies to track their sales momentum and market performance over time.

While GMV is essential for understanding scale, it needs to be evaluated alongside other metrics to paint a complete picture of business health.

What is GMV?

Gross Merchandise Value (GMV) represents the total monetary value of all items sold through a marketplace over a specific time period. Unlike revenue, GMV does not include deductions such as discounts, returns, or taxes. It is an important metric for understanding the scale of a business’s operations.

How is GMV Calculated?

The formula for GMV is straightforward:

GMV = Total Units Sold × Price per Unit

For example, if a marketplace sells 1,000 units of a product priced at $50 each, the GMV would be $50,000. This calculation provides a clear view of the gross sales volume but does not reflect the business’s actual earnings.

What Does GMV Tell You?

GMV helps businesses gauge their market presence and transaction volume, serving as an indicator of a platform’s scale and sales momentum. However, it’s important to analyze GMV alongside other financial metrics for a full picture of performance.

Key points:

Key points:

- Market Presence: High GMV often signals strong customer engagement and robust sales activity, but it does not account for profitability.

- Trend Identification: GMV can reveal trends in consumer behavior, such as seasonal demand or product category preferences.

- Benchmarking: GMV serves as a benchmark for comparing performance across platforms or time periods, helping businesses assess growth or market share.

By combining GMV analysis with metrics like revenue, net profit, and return rates, businesses can derive actionable insights and improve decision-making.

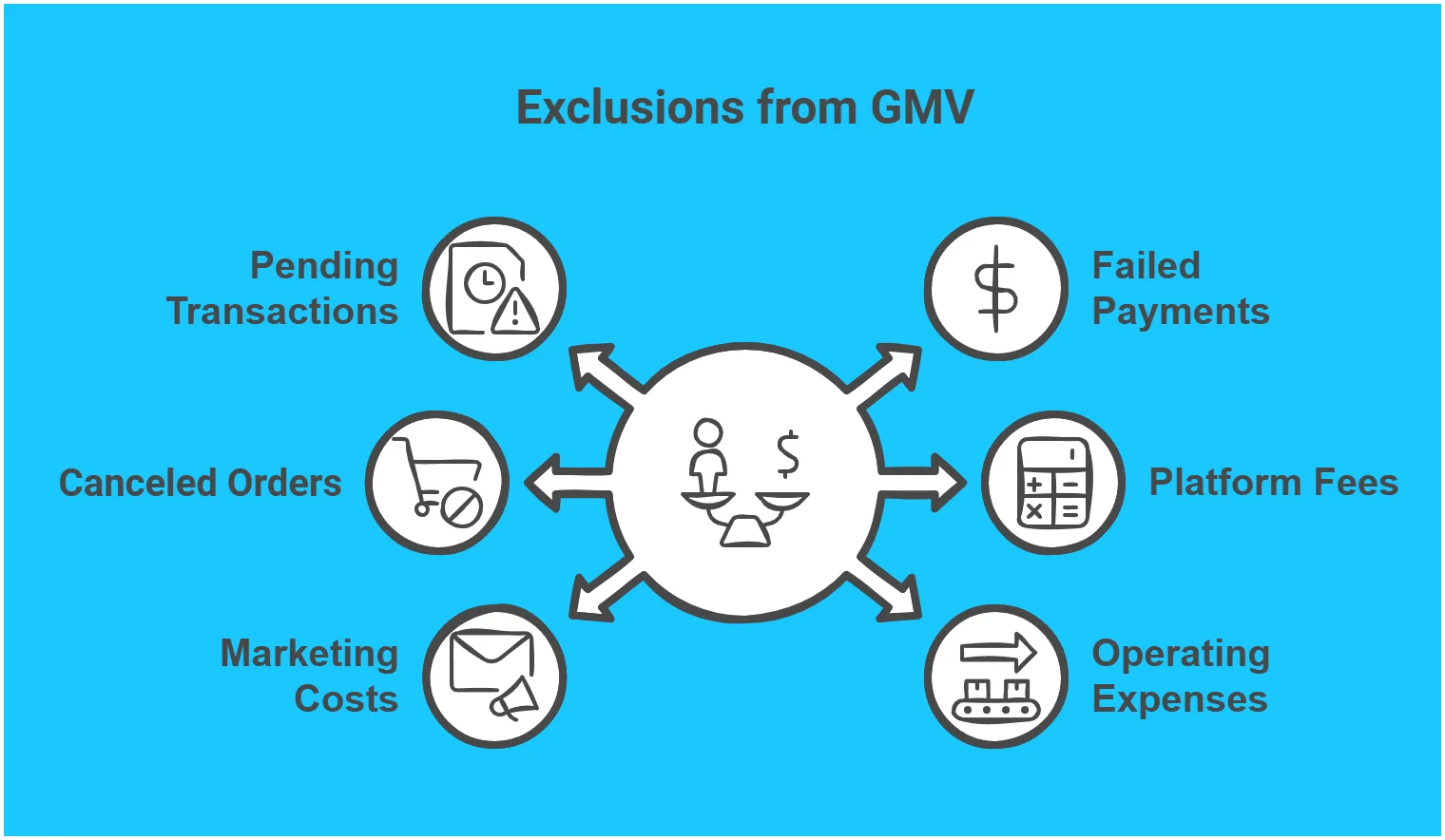

What GMV Doesn’t Include

- Pending transactions

- Failed payments

- Canceled orders before shipment

- Platform fees and commissions

- Marketing costs

- Operating expenses

Why GMV Matters

GMV serves as the primary valuation metric for marketplace businesses. Investors typically value platforms at a multiple of their GMV because it indicates the total economic activity the platform enables. For instance, a marketplace with $100M GMV might be valued at $150M (1.5x GMV) if it shows strong growth and healthy margins.

Platform operators use GMV to measure their market penetration. When a platform’s GMV grows from $10M to $20M in a region, it signals strengthening market position, even if revenue grows at a different rate due to varying commission structures.

GMV also guides strategic decisions about pricing and commissions. A platform with $50M GMV can model how different commission rates (5%, 10%, 15%) would impact both marketplace activity and revenue, helping balance growth with profitability.

GMV vs Other Metrics

Understanding the differences between business metrics can be confusing. Let’s break down each comparison with real-world examples from an electronics marketplace.

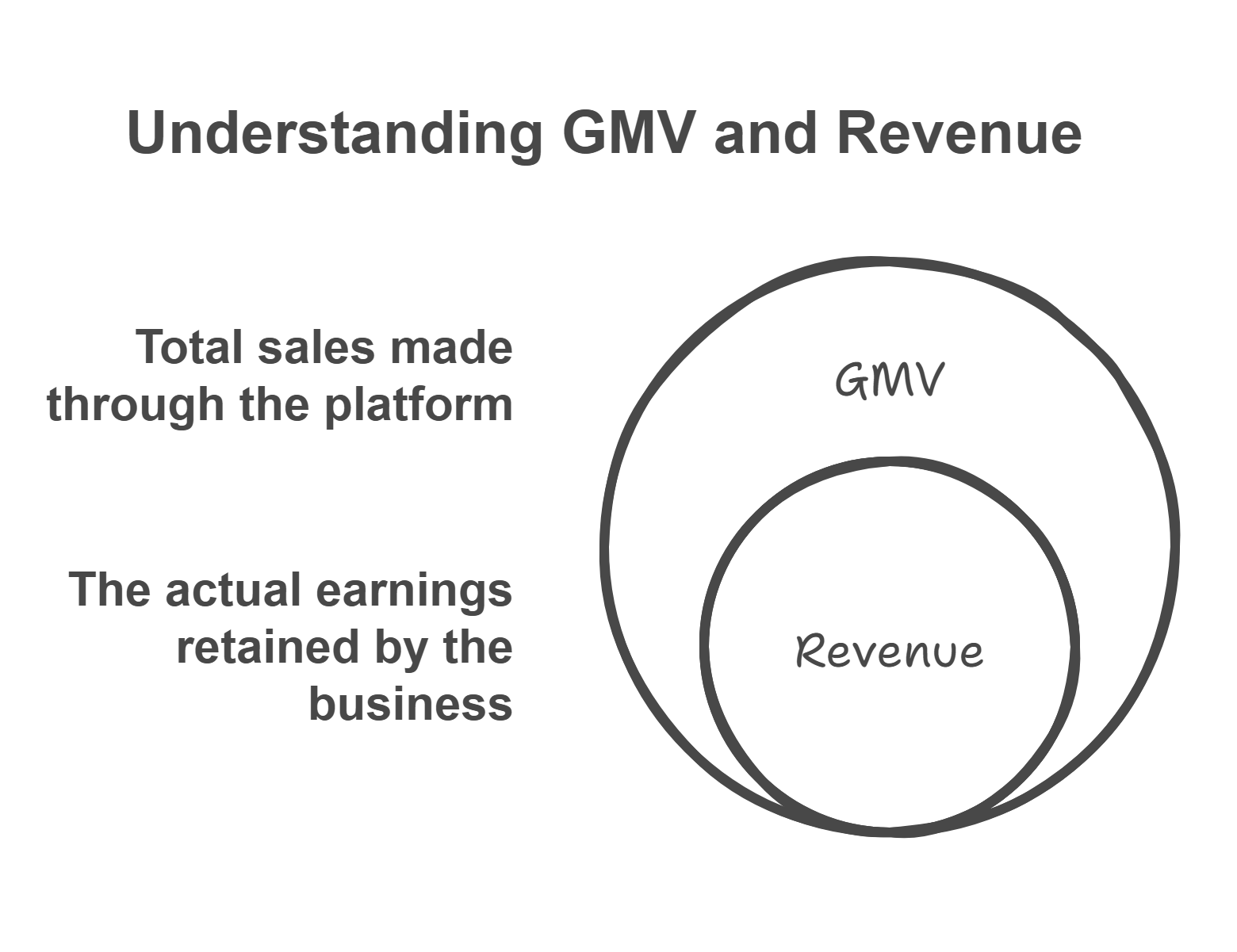

GMV vs Revenue

GMV represents the total sales through your platform, while revenue is the portion you actually keep as a business.

Take an electronics marketplace selling a gaming console. When a customer buys a console for $500, the GMV is the full $500, but the marketplace’s revenue is just $50 (assuming a 10% commission).

With 1,000 similar transactions, you’d see $500,000 in GMV but only $50,000 in revenue. This explains why platforms report both metrics—GMV shows business scale, revenue shows actual earnings.

GMV vs TPV (Total Payment Volume)

GMV only counts product sales, while TPV includes every single money movement on your platform.

In our electronics marketplace, a customer makes several transactions: buys a $500 gaming console, adds $100 to their store wallet, and gets a $50 refund on a previous purchase. The GMV is just $500 (the console sale), but TPV is $650 (all money movements).

This matters because payment providers earn from all transfers, while marketplaces care about actual sales.

GMV vs CTV (Customer Transaction Value)

GMV shows total platform sales, while CTV reveals how much each customer spends.

Your electronics marketplace achieves $100,000 monthly GMV. This could mean 200 customers each buying a $500 console, or 20 customers each spending $5,000 on full gaming setups. Same GMV, but vastly different customer behaviors and business risks.

GMV vs Turnover

GMV counts only successful sales, while turnover includes all business activity regardless of completion.

Looking at daily numbers, your marketplace processes orders worth $50,000. After removing cancellations ($5,000), failed payments ($3,000), and returns ($2,000), your GMV is $40,000. Your turnover remains $50,000 because it reflects all activity, not just successful sales.

GMV vs MRP (Maximum Retail Price)

GMV reflects actual sales value, while MRP represents the maximum legal selling price.

Your marketplace sells gaming consoles with an MRP of $600, but market competition drives actual selling price to $500. When you sell 100 units, the MRP value is $60,000, but your GMV is $50,000. This gap reveals competitive pressure in your market.

Understanding Revenue: Definition, Comparison, and Calculation

While GMV shows the total value flowing through your business, revenue represents the money you actually keep. Understanding how to calculate and interpret revenue helps you make better business decisions and avoid common accounting mistakes.

Revenue Calculation

Revenue is the total amount of money a business earns from its activities before any costs are deducted.

The calculation changes based on your business model. For marketplaces, it’s a straightforward commission on GMV – if you process $100,000 in sales with a 10% commission, your revenue is $10,000.

Traditional retailers calculate revenue differently: if you sell $100,000 worth of products, subtract returns ($5,000) and discounts ($2,000), your actual revenue is $93,000.

Sales vs Revenue

Sales represent the total value of transactions, while revenue is what remains after accounting for returns, discounts, and adjustments.

Take a clothing store’s daily performance: they ring up $10,000 in sales, but customers return $1,000 worth of items and use $500 in discounts. Their actual revenue is $8,500. This distinction becomes crucial for accurate financial planning and reporting.

Gross vs Net Revenue

Gross revenue is your total earnings before deducting sales-related costs, while net revenue is what remains after these deductions.

Consider a marketplace transaction: When your platform processes a $1,000 sale with a 10% commission, you earn $100 in gross revenue. However, this isn’t what you keep.

After subtracting payment processing ($3), return handling ($2), and chargeback reserves ($1), your net revenue becomes $94. Understanding this difference helps you price your services correctly and maintain healthy margins.

Merchandising Revenue

Merchandising revenue is the total sales value of goods, not just the markup or profit margin.

When you buy a product for $70 and sell it for $100, your revenue is the full $100, not just your $30 markup. This matters for tax purposes and financial reporting because revenue recognition in merchandising follows different rules from marketplace or service businesses.

Profit vs Revenue

Revenue is all money earned from business activities, while profit is what remains after paying all business expenses.

A retail store might generate $100,000 in monthly revenue, but after paying for products ($60,000), staff ($20,000), and rent ($10,000), their actual profit is $10,000. This explains why businesses can have impressive revenue figures but still struggle with profitability.

GMV and Revenue in Practice

Understanding how GMV and revenue work in real business scenarios helps clarify their practical applications and tax implications. Let’s examine how major platforms use these metrics and handle their tax obligations.

GMV in Major Platforms

Each platform’s GMV reveals different aspects of their business model and market position.

Amazon’s GMV reached approximately $734 billion in 2023, while their revenue was $143 billion. This means Amazon keeps roughly 19.5% of transaction value, higher than most marketplaces because they combine marketplace fees with direct retail sales.

TikTok Shop’s GMV grows differently: from $4.4 billion in 2022 to an estimated $15 billion in 2023. Their lower revenue percentage (roughly 5% of GMV) reflects their strategy of prioritizing growth over immediate monetization.

eBay’s GMV tells another story: $73.5 billion in 2023 with $9.8 billion in revenue, suggesting a consistent 13% take rate focused on sustainable marketplace operations.

Bonus: For current statistics and insights on GMV, revenue, and market performance of leading brands and marketplaces worldwide, visit Statsup.

Tax Implications of GMV Revenue

Tax obligations are calculated on revenue, not GMV, but understanding both helps prevent costly mistakes.

When a marketplace processes $1 million in GMV with a 10% commission ($100,000 revenue):

- Sales tax applies to the full GMV ($1 million) but is collected from buyers

- Income tax applies only to the revenue ($100,000)

- Merchants pay taxes on their portion ($900,000)

This creates three distinct tax streams:

- Platform’s tax on commission revenue

- Merchants’ tax on their sales revenue

- Sales tax collected from customers

Platform Revenue Reporting

Different business models require different reporting approaches for tax compliance.

A platform processing $10 million GMV monthly earns $1 million in commission revenue. While tax obligations focus on this $1 million, proper reporting requires clear documentation of both figures. Marketplaces must maintain separate records for GMV and revenue, establish transparent commission structures, and track cross-border transactions carefully.

This documentation serves multiple purposes beyond tax compliance. It helps demonstrate business value to investors, analyze market position against competitors, and provide supporting evidence during tax audits.

For instance, when a marketplace shows consistent GMV growth from $10M to $15M while maintaining a 10% commission rate, it signals both business health and reliable revenue generation.

Frequently Asked Questions

Here are the answers to the most common questions about GMV and revenue:

Is GMV the Same as Volume?

GMV (Gross Merchandise Value) differs from volume in a crucial way. Volume refers to the number of transactions or items sold, while GMV represents their monetary value. For example, selling 1,000 items at $10 each and selling 100 items at $100 each both give you $10,000 GMV, but very different volumes (1,000 vs 100 units).

What’s the Difference Between GMV and ACV (Annual Contract Value)?

GMV measures total transaction value for any period, while ACV normalizes subscription contract values to an annual figure. If a customer signs a 2-year contract worth $24,000, the GMV is $24,000, but the ACV is $12,000 ($24,000 ÷ 2 years). This distinction matters because ACV helps compare contracts of different lengths, while GMV shows actual transaction value.

What’s the Difference Between Net Sales and GMV?

Net sales subtract returns, discounts, and allowances from total sales, while GMV represents the full transaction value before these deductions. For example, if a store has $100,000 in total sales, $5,000 in returns, and $2,000 in discounts, their net sales would be $93,000, but their GMV remains $100,000.

What’s the Difference Between GMV and CTV (Customer Transaction Value)?

While GMV shows total platform transactions, CTV (Customer Transaction Value) measures average spending per customer. If your platform has $1 million GMV from 10,000 customers, your CTV is $100. This helps understand customer behavior and value at an individual level.

Is Turnover and GDP the Same Thing?

Turnover measures a single business’s total revenue over a period, while GDP measures an entire economy’s output. For example, a company might have $10 million in annual turnover, but this is just one small part of a country’s GDP, which measures all economic activity including services, investments, and government spending.

What’s the Difference Between GMV and MRP (Maximum Retail Price)?

GMV reflects actual transaction values, while MRP represents the highest legal selling price. In markets where MRP is mandatory, a product with an MRP of $50 might sell for $45, making the GMV $45. This difference between MRP and GMV often indicates market competition levels and pricing strategies.