The United States and the United Kingdom maintain one of the world’s largest bilateral trade relationships, with total trade in goods and services reaching £294.1 billion in the four quarters to the end of Q3 2024.

This represents a slight decrease of 2.3% (£6.8 billion) from the same period in 2023, according to UK government statistics.

This represents a slight decrease of 2.3% (£6.8 billion) from the same period in 2023, according to UK government statistics.

The US stands as the UK’s largest trading partner, accounting for 17.2% of all UK trade. This economic relationship encompasses a wide range of sectors, with services dominating UK exports to the US while goods and services imports are more evenly balanced.

Key points about the US-UK trade relationship:

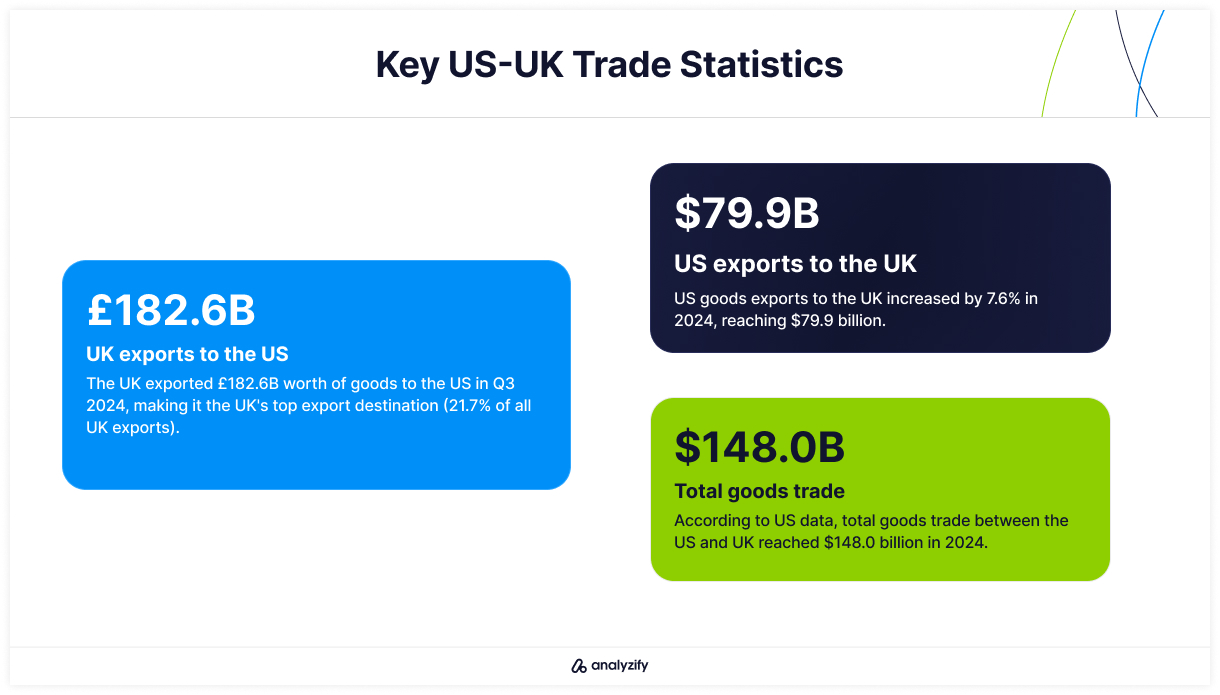

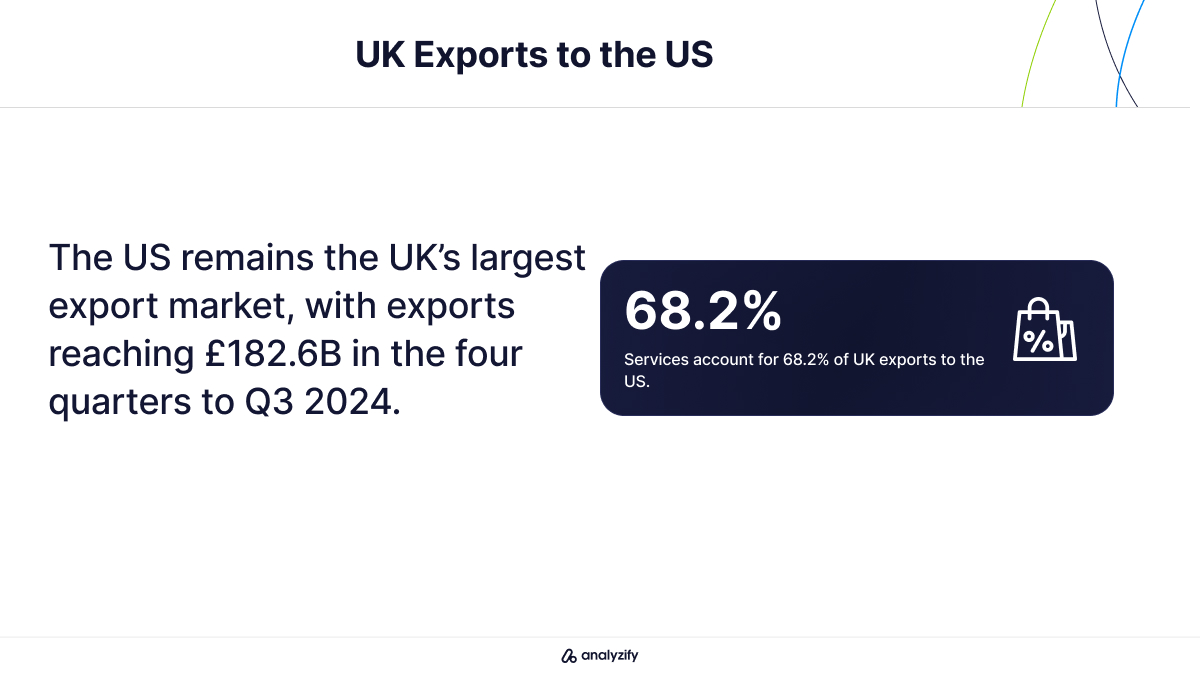

- The United Kingdom exported £182.6 billion to the US in the year to Q3 2024, making America the UK’s largest export market and accounting for 21.7% of all UK exports globally.

- According to US data, total goods trade with the UK was estimated at $148.0 billion in 2024, with US goods exports to the UK reaching $79.9 billion (up 7.6% from 2023).

- The US recorded a goods trade surplus with the UK of $11.9 billion in 2024, representing a 17.4% increase ($1.8 billion) over 2023 according to American statistics.

- This trade relationship has gained heightened attention recently due to President Donald Trump’s statements about potential new tariffs on imports to the United States.

This trade relationship has complex dimensions, with different statistical measurements between the two countries creating different pictures of who benefits more from trade.

These statistical differences have become particularly relevant as the UK government works to position itself favorably in discussions about potential US tariffs.

Bonus: Learn about US-Canada Trade Statistics: Commerce Under New Tariffs!

US-UK Trade Balance: Who Has the Surplus?

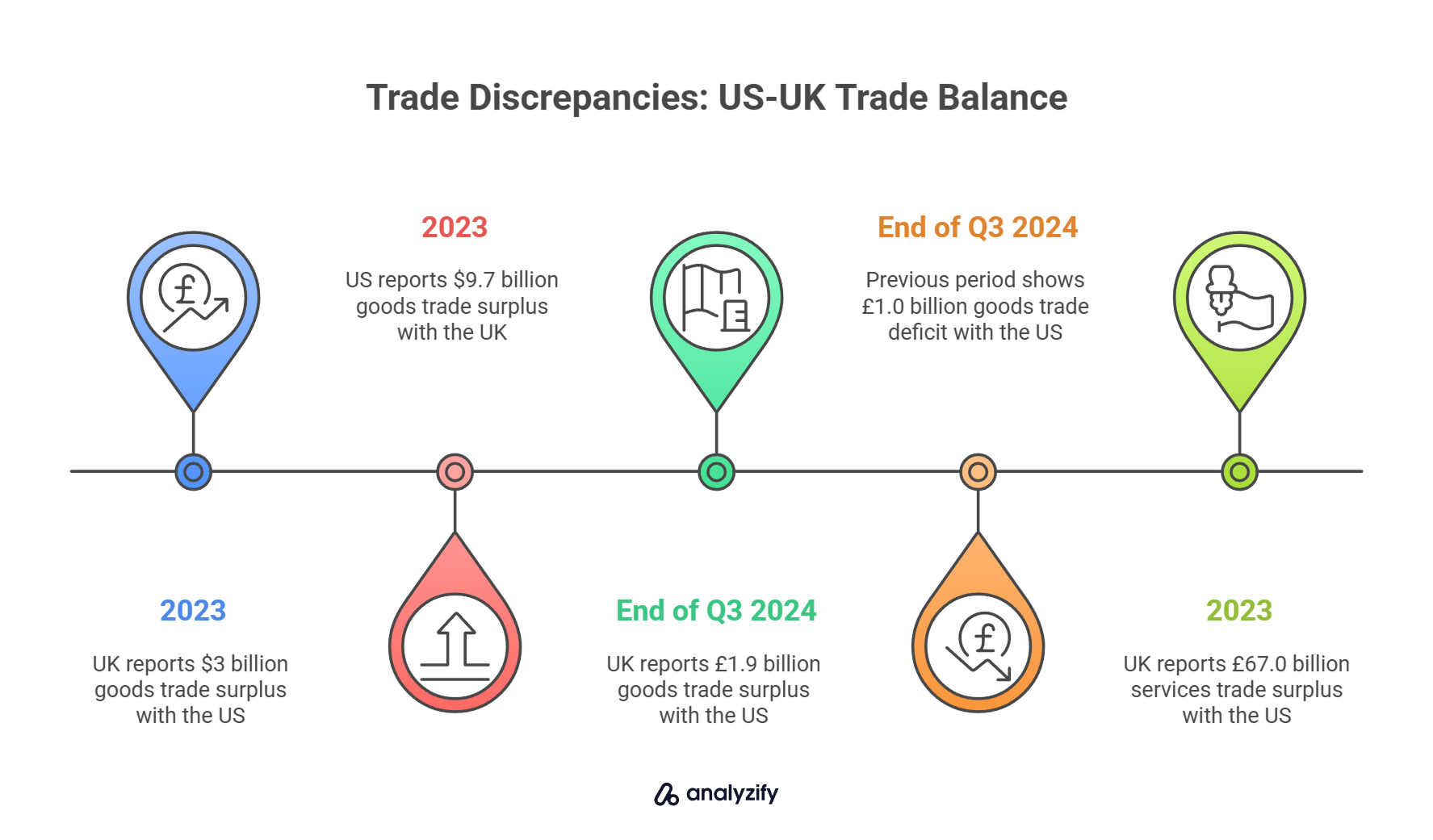

One of the most contentious aspects of US-UK trade relations centers on a peculiar statistical anomaly: both countries claim to have a trade surplus with each other.

This discrepancy has gained political importance amid President Trump’s focus on trade deficits as justification for imposing tariffs.

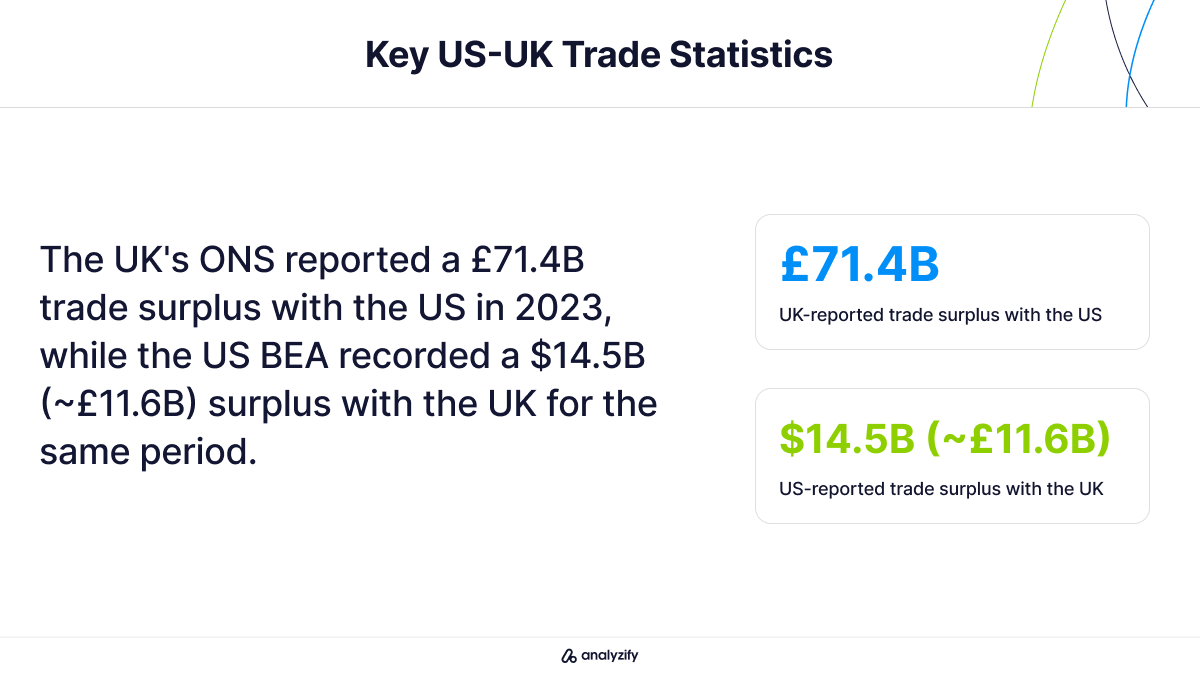

According to the UK’s Office for National Statistics (ONS), the UK reported a total trade surplus of £71.4 billion with the US in 2023.

However, the United States Bureau of Economic Analysis (BEA) reports a surplus of $14.5 billion (approximately £11.6 billion) with the UK for the same period.

Key points about this statistical discrepancy:

Key points about this statistical discrepancy:

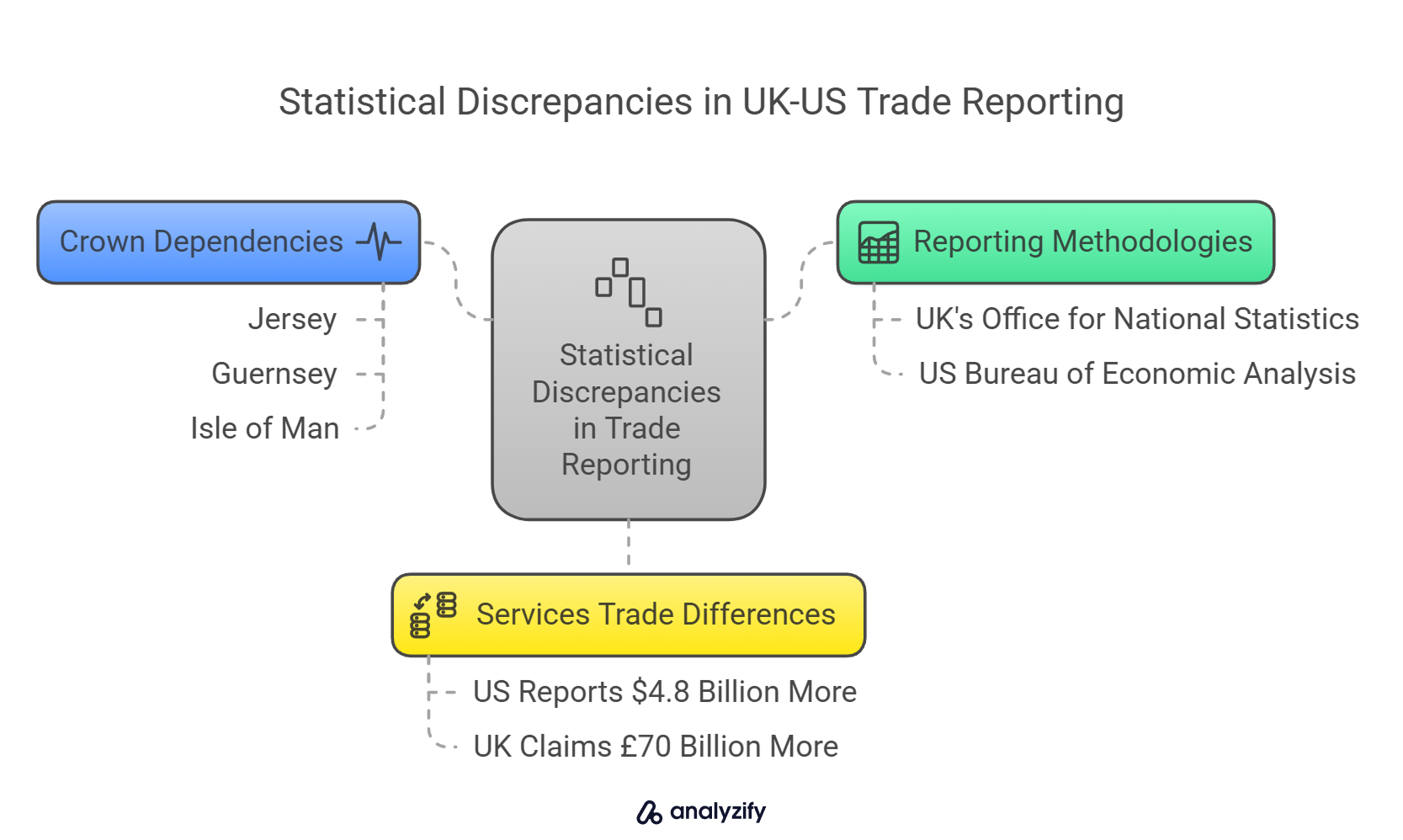

- The different reporting methodologies create a situation where each country believes it sells more to the other than it buys, which has significant implications for trade policy discussions.

- The UK government is strategically referencing US data in its discussions with the Trump administration, as one senior British official joked: “Using America’s own trade data provides a shared and strong foundation when engaging in discussions with our American friends.”

- Crown Dependencies like Jersey, Guernsey, and the Isle of Man significantly affect the statistics — the US Bureau of Economic Analysis includes trade with these territories in UK data, while the ONS does not.

- The greatest differences appear in services trade: the US reports exporting $4.8 billion more in services to the UK than it imports, while the UK claims to export nearly £70 billion more to the US than it imports.

Goods vs. Services Trade Balance

Breaking down the balance by type of trade:

- The UK reported a goods trade surplus of about $3 billion with the US in 2023, while US data shows America had a $9.7 billion goods trade surplus with the UK for the same period.

- For the four quarters to the end of Q3 2024, the UK data showed a trade in goods surplus of £1.9 billion with the US, compared to a trade in goods deficit of £1.0 billion in the previous comparable period.

- In services trade, the UK reported a surplus of £67.0 billion with the US in 2023, representing the largest component of the overall UK trade surplus with America.

Both countries’ statistics offices are aware of these differences and have been cooperating to align their methodologies since 2017, though substantial gaps remain.

The ONS notes that “differences can be caused by a range of conceptual and measurement variations between the estimation practices of different countries.”

What the UK Exports to the US: Key Products and Services

The United Kingdom’s exports to the United States reached £182.6 billion in the four quarters to the end of Q3 2024, making the US the UK’s largest export market by a significant margin.

These exports span both goods and services, with services making up the majority at 68.2% of total exports to the US.

Top UK Goods Exported to the US

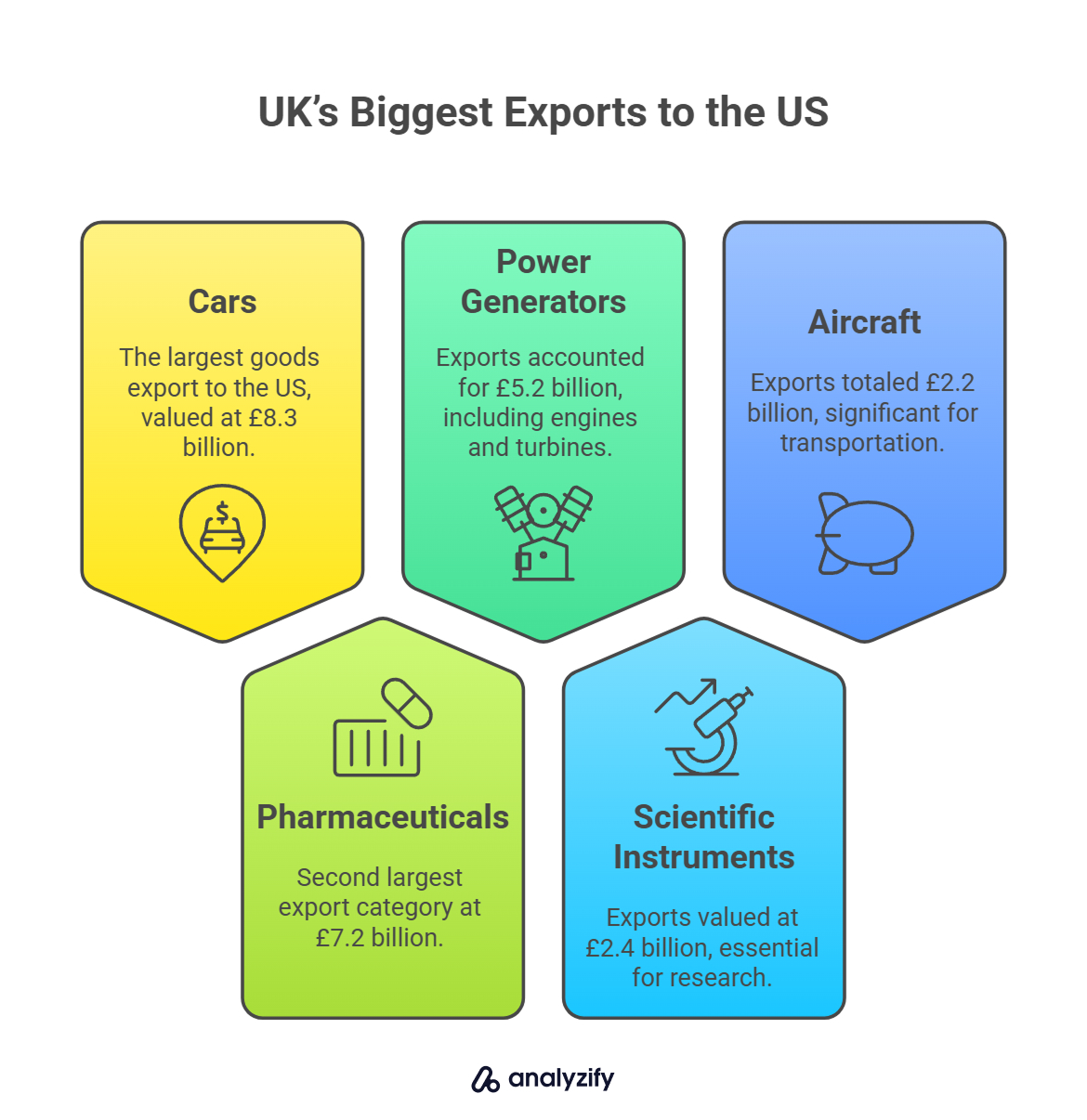

In the four quarters to the end of Q3 2024, UK goods exports to the US totaled £58.1 billion, accounting for 31.8% of total exports to America. The composition of these exports reveals the UK’s industrial strengths and key trading sectors.

Main goods exports from the UK to the US include:

- Cars were the UK’s largest goods export to the US, valued at £8.3 billion and representing 13.9% of all goods exports to America in the year to Q3 2024. This marks a significant increase of 16.9% compared to the previous year.

- Medicinal and pharmaceutical products ranked as the second largest export category at £7.2 billion (12.0% of goods exports), though this represented a decrease of 15.7% from the previous year.

- Mechanical power generators, including components such as internal combustion engines and turbines, accounted for £5.2 billion (8.8%) of exports and grew by 15.2% year-on-year.

- Scientific instruments (£2.4 billion) and aircraft (£2.2 billion) rounded out the top five goods export categories.

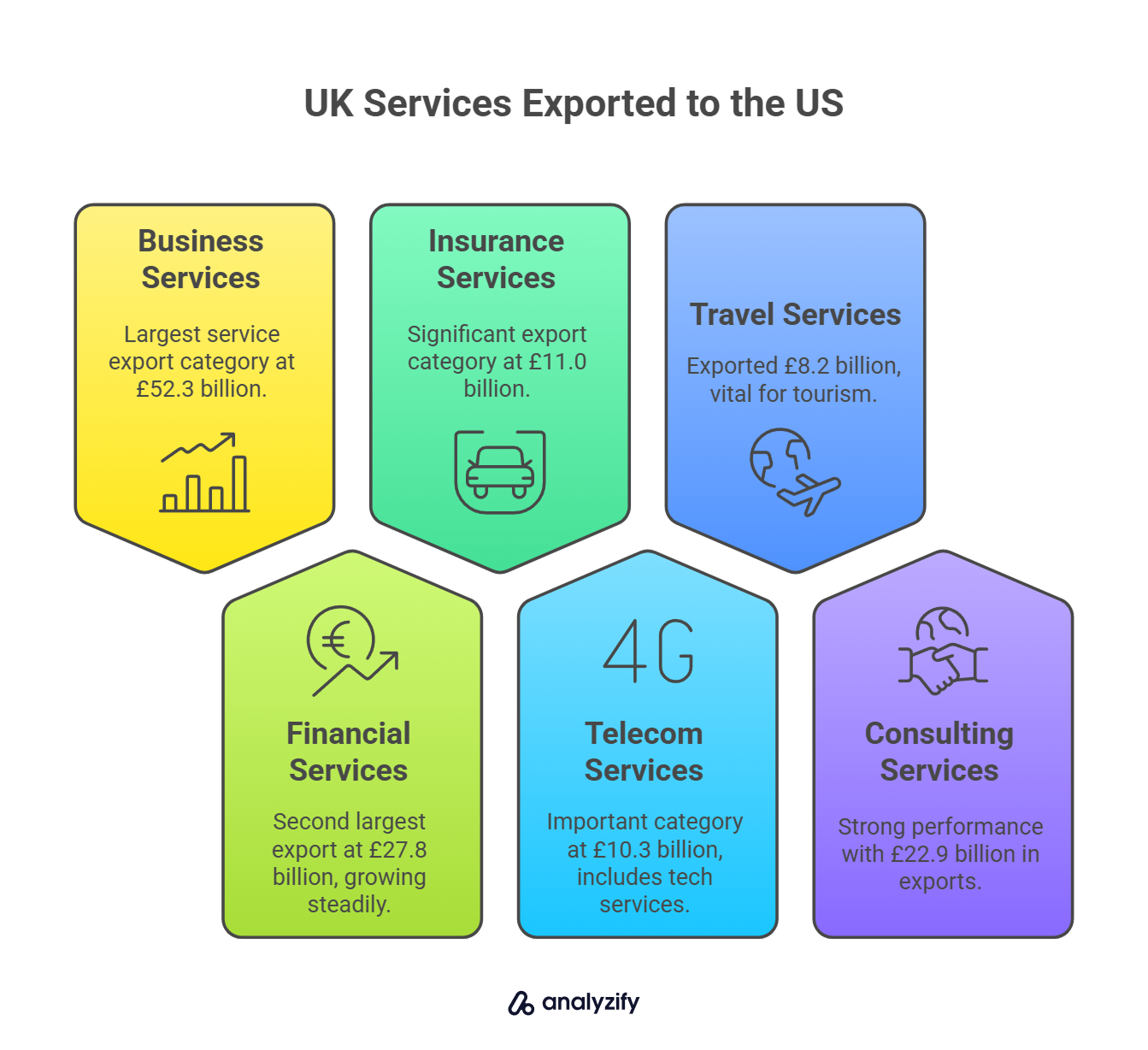

Leading UK Services Exports to the US

Services dominate the UK’s export relationship with the US, with £124.4 billion exported in the four quarters to Q3 2024, an increase of 2.6% (£3.2 billion) compared to the previous year.

Key services exported from the UK to the US include:

Key services exported from the UK to the US include:

- Other business services represented the largest service export category at £52.3 billion, making up 42.1% of all service exports to the US. This broad category includes research and development, professional consulting, and technical services.

- Financial services ranked second at £27.8 billion (22.3% of service exports), growing by 6.6% compared to the previous year.

- Insurance and pension services (£11.0 billion), telecommunications/computer services (£10.3 billion), and travel services (£8.2 billion) were also significant export categories.

- Business and management consulting and public relations services were particularly strong within the broader business services category, with £22.9 billion exported to the US in 2023, accounting for over half (54.8%) of all UK exports of this service type.

The UK’s export profile to the US reflects its comparative advantages in high-value manufacturing like automobiles and pharmaceuticals, as well as its globally competitive services sector, particularly in financial and business services centered in London and other major cities.

What the UK Imports from the US: Primary Goods and Services

The United Kingdom imported £111.5 billion from the United States in the four quarters to the end of Q3 2024, representing a decrease of 5.1% (£5.9 billion) compared to the same period in 2023. These imports are almost evenly split between goods and services, with goods accounting for 50.5% of total imports from the US.

Major Goods Imports from the US

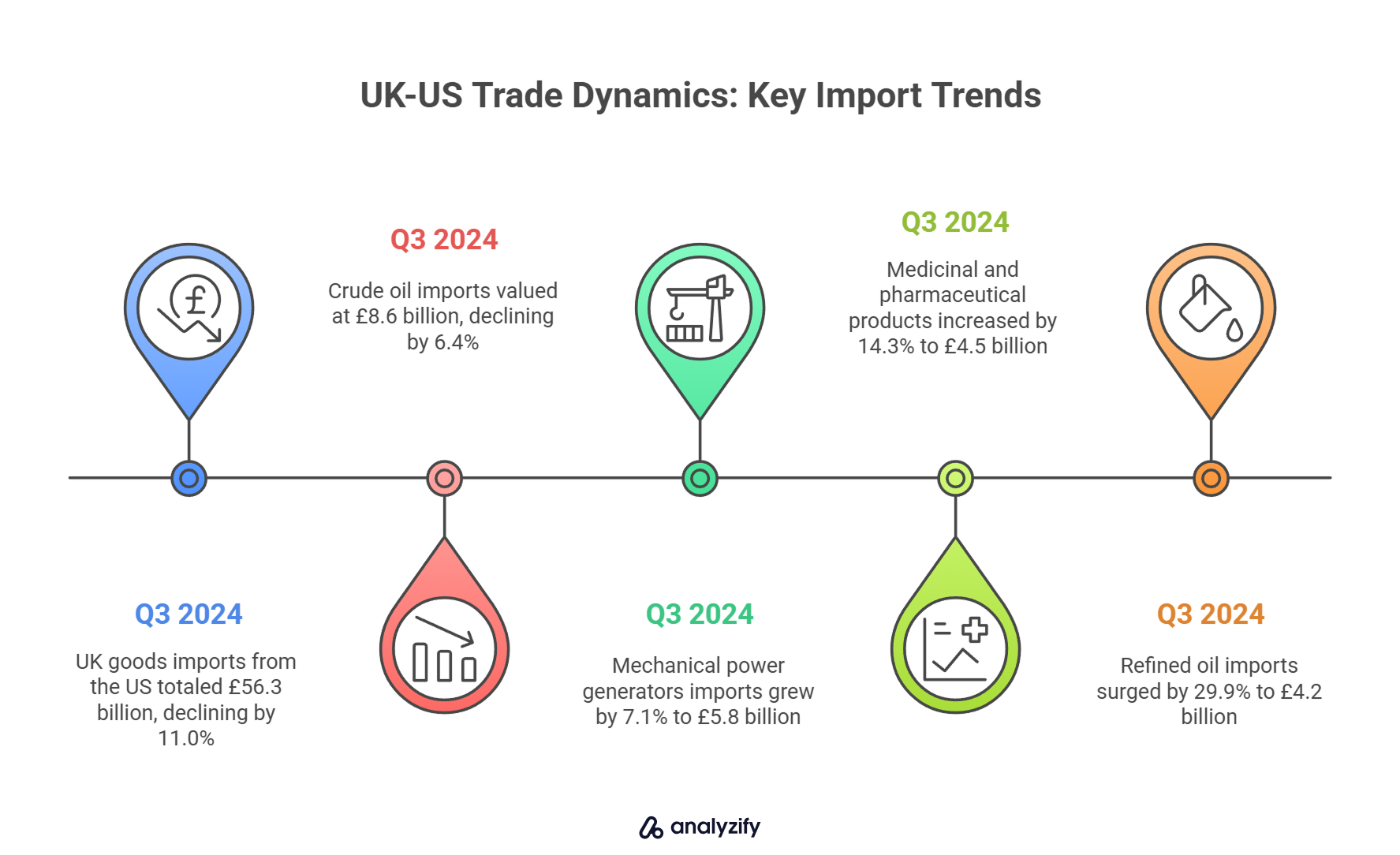

UK goods imports from the United States totaled £56.3 billion in the four quarters to Q3 2024, declining by 11.0% (£6.9 billion) compared to the previous year. This decline occurred across several key product categories.

Top goods imported from the US to the UK include:

Top goods imported from the US to the UK include:

- Crude oil was the largest import category, valued at £8.6 billion and comprising 15.3% of all goods imports from the US. Despite its prominence, crude oil imports declined by 6.4% compared to the previous year.

- Mechanical power generators ranked as the second-largest import at £5.8 billion (10.3% of goods imports), growing by 7.1% year-on-year.

- Medicinal and pharmaceutical products accounted for £4.5 billion (8.0%) of imports and increased significantly by 14.3% from the previous comparable period.

- Refined oil saw substantial growth, with imports increasing by 29.9% to reach £4.2 billion (7.5% of goods imports).

The energy relationship is particularly notable, with the UK importing both crude and refined oil products worth a combined £12.8 billion in the year to Q3 2024, highlighting the importance of US energy exports since the shale revolution increased American production capacity.

Key Services Imports from the US

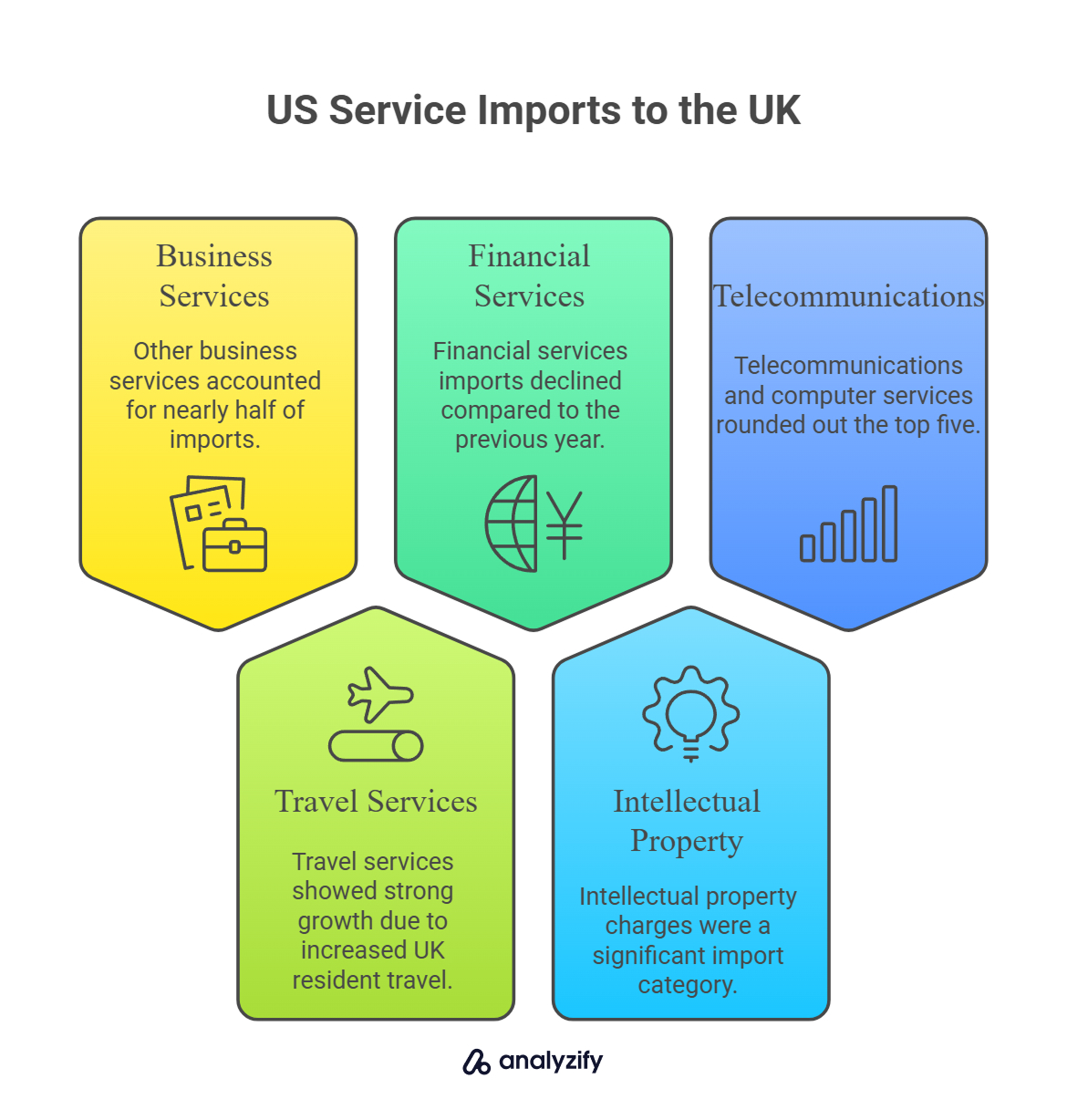

Services imports from the United States totaled £55.2 billion in the four quarters to Q3 2024, showing modest growth of 1.8% (£985 million) compared to the previous year.

Primary services imported from the US to the UK include:

Primary services imported from the US to the UK include:

- Other business services dominated imports at £27.2 billion, accounting for nearly half (49.1%) of all service imports from the US. This category grew slightly by 0.7% year-on-year.

- Travel services ranked second at £7.5 billion (13.6% of service imports) and showed strong growth of 12.4%, reflecting increased UK resident travel to the United States.

- Financial services imports were valued at £6.4 billion (11.6%) but declined by 2.6% compared to the previous year.

- Intellectual property charges (£4.9 billion) and telecommunications/computer services (£3.5 billion) rounded out the top five service import categories.

Within the business services category, the UK primarily imported services between affiliated enterprises (£9.2 billion in 2023) and intragroup fees and cost recharge (£6.4 billion), highlighting the significant role of intra-company transactions between US and UK businesses with multinational operations.

The import profile reflects both the US’s strengths in energy production and high-value services, as well as the deep corporate connections between businesses operating across both countries.

US-UK Trade in Numbers: Latest Statistics

The trade relationship between the United States and the United Kingdom represents a substantial economic partnership that has evolved over time. Recent statistics provide insight into the current state and trends of this bilateral trade relationship.

Overall Trade Volume and Recent Trends

Total trade between the UK and US has seen slight contraction recently:

- The value of total UK-US trade (exports plus imports) was £294.1 billion in the four quarters to the end of Q3 2024, representing a decrease of 2.3% (£6.8 billion) from the same period a year earlier.

- Despite this recent decrease, the United States remains the UK’s largest trading partner, accounting for 17.2% of total UK trade.

- The UK maintained a significant overall trade surplus with the US, reaching £71.1 billion in the year to Q3 2024, up from £66.0 billion in the previous comparable period.

Goods vs. Services Breakdown

The composition of UK-US trade shows distinct patterns in goods versus services:

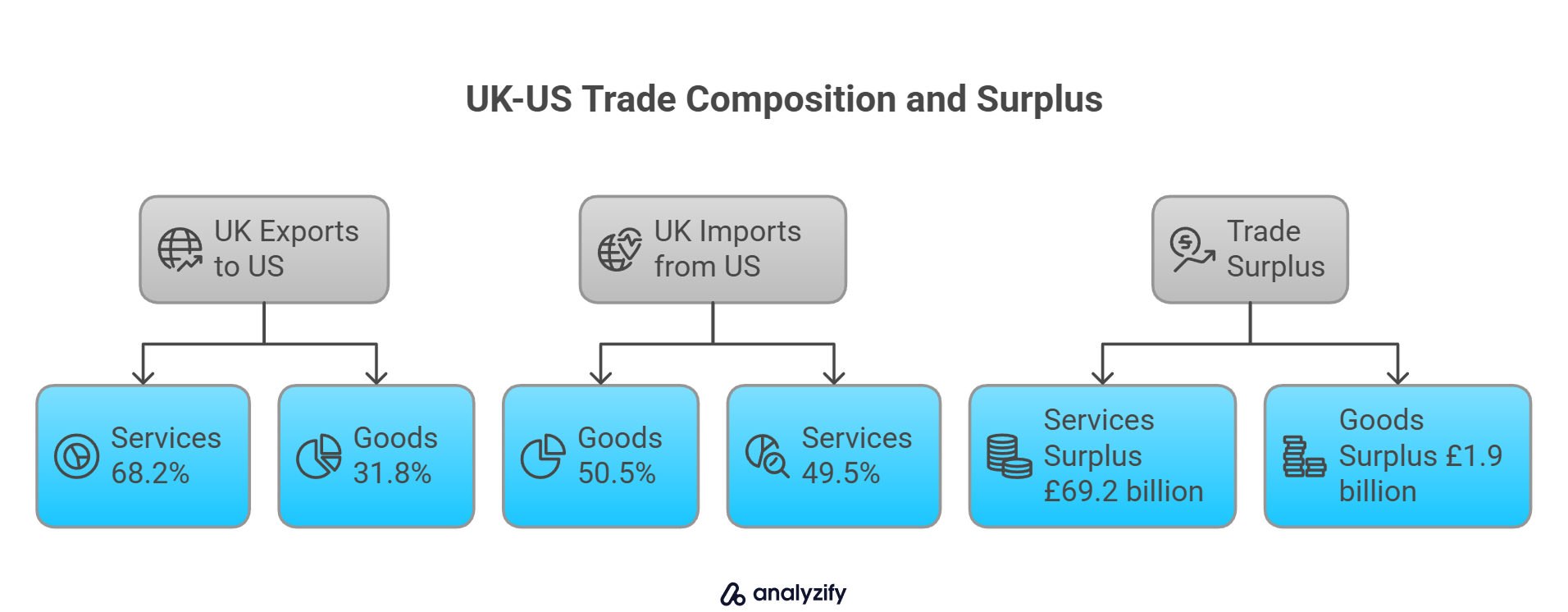

- Services dominate UK exports to the US, accounting for 68.2% (£124.4 billion) of total exports in the year to Q3 2024, while goods made up 31.8% (£58.1 billion).

- UK imports from the US are more balanced, with goods representing 50.5% (£56.3 billion) and services 49.5% (£55.2 billion) of total imports in the same period.

- The UK’s trade surplus with the US primarily stems from services, with a services surplus of £69.2 billion compared to a more modest goods surplus of £1.9 billion in the year to Q3 2024.

Regional Distribution of UK-US Trade

Trade with the US varies significantly across UK regions:

- The West Midlands led goods exports to the US in 2023 with £7.3 billion (13.0% of UK total), largely driven by automotive exports, followed by the East (£6.2 billion) and South East (£6.3 billion).

- London and the South East dominated goods imports from the US, each accounting for 19.3% of total UK imports from America (£11.0 billion each in 2023).

- Northern Ireland had the lowest trade volume with the US among UK regions, with £1.5 billion in exports (2.7% of UK total) and £0.8 billion in imports (1.5% of UK total).

Business Participation in UK-US Trade

The trade relationship involves thousands of businesses across both countries:

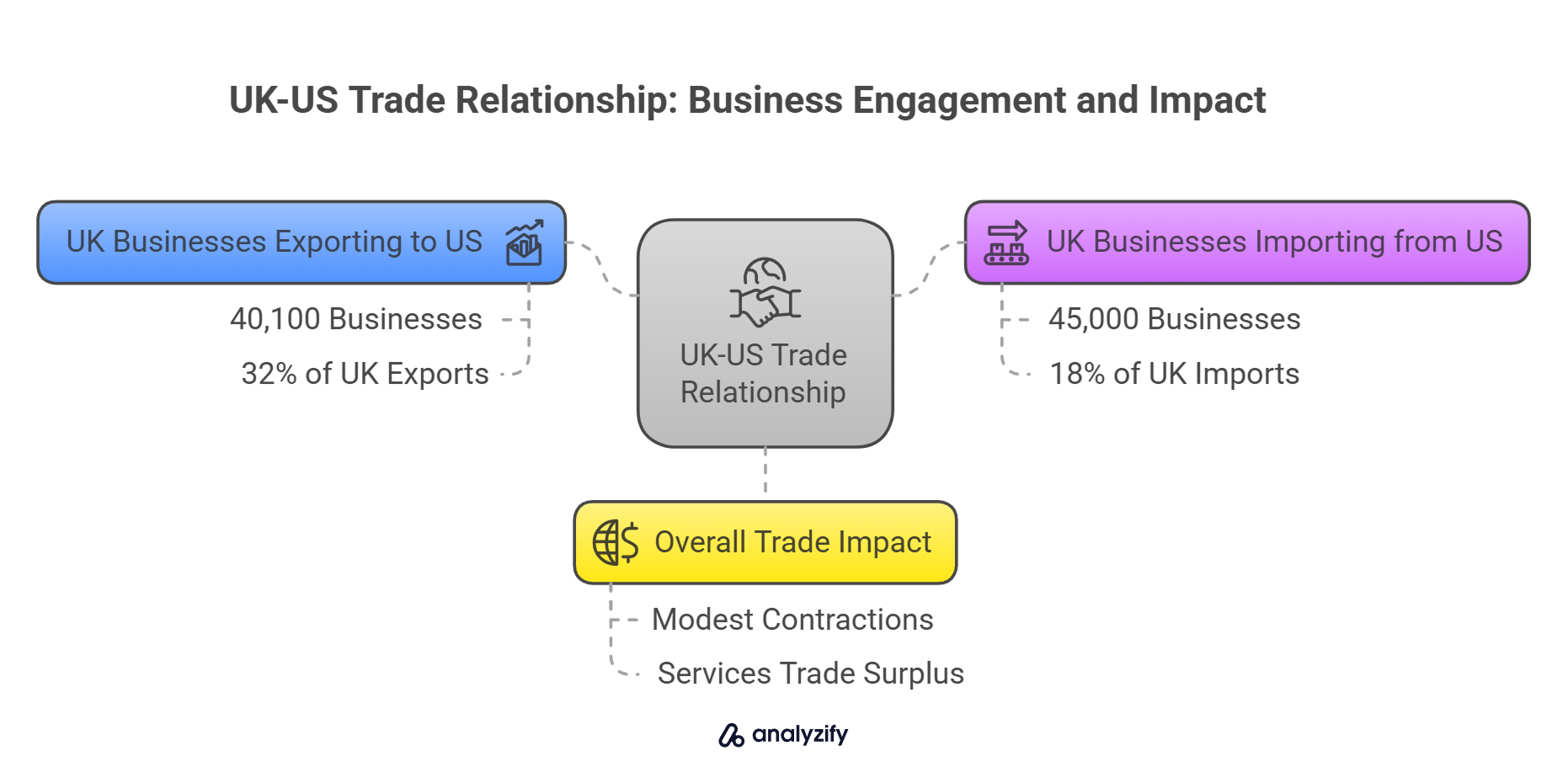

- Approximately 40,100 UK VAT-registered businesses exported goods to the United States in 2023.

- Around 45,000 UK VAT-registered businesses imported goods from the US in the same year.

- This represents roughly 32% of all UK businesses engaged in goods exports globally (125,600) and 18% of UK businesses importing goods worldwide (251,200).

The data shows the US-UK trade relationship remains substantial despite recent modest contractions, with services trade driving the UK’s overall surplus and business engagement spanning tens of thousands of companies on both sides of the Atlantic.

Potential Tariff Threats: Impact on UK Trade

Statements about potential new tariffs have created uncertainty for UK exporters and policymakers. While his administration’s primary focus appears to be on countries with large trade deficits with the US, the UK is working to position itself favorably in these discussions.

Recent Statements on UK Trade

Trump’s comments have specifically mentioned the UK:

- In a recent BBC interview, Trump stated that “the UK is way out of line but I’m sure that one… I think that one can be worked out,” without specifying exactly what he meant by “out of line.”

- The president has threatened punitive tariffs targeting countries with significant trade deficits with the US, though his primary focus appears to be on goods rather than services trade.

- Trump has already announced tariffs on Mexico and Canada, and has complained about “unbalanced trade” with the EU, stating: “They don’t take our cars, they don’t take our farm products, they take almost nothing and we take everything from them.”

Potential Tariff Scenarios for UK Exports

If tariffs were applied to UK exports, the impact could be substantial:

- A blanket tariff on UK exports to the US would affect around £60 billion of goods sent in 2023, according to UK figures.

- Key vulnerable sectors include pharmaceutical products (£8.8 billion of UK exports to the US in 2023), cars (£6.4 billion), and power generation machinery (£5.2 billion).

- Any tariffs would initially make these products more expensive for US consumers and businesses, but over time could reduce American demand for UK goods.

- Trump has threatened tariffs of between 10% and 20% on products imported by the United States, with potentially higher rates for specific countries like China, Canada, and Mexico.

UK Government Response and Strategy

The UK is actively working to mitigate potential tariff risks:

- Prime Minister Sir Keir Starmer and UK Ambassador to Washington Lord Mandelson are leveraging the statistical discrepancy in trade figures, focusing on US data that shows America has a trade surplus with Britain.

- The UK government is emphasizing that according to US figures, America ran an overall trade surplus with the UK in 2023 of $14.5 billion, which would logically exempt Britain from Trump’s focus on countries with which the US has deficits.

- UK officials are specifically highlighting the US goods trade surplus with Britain (using US figures) in their discussions, as Trump’s tariff focus appears to be primarily on goods rather than services trade.

Even if the UK avoids direct tariffs, economists warn of indirect effects through other channels. The National Institute of Economic and Social Research has estimated that the 25% tariffs the US has threatened to impose on Mexico and Canada could reduce UK GDP growth by 0.1 percentage points in 2025 through supply chain disruptions, currency effects, and diverted exports from other countries flooding UK markets.

US-UK Free Trade Agreement: Status and Prospects

The pursuit of a comprehensive free trade agreement (FTA) between the United States and the United Kingdom has been a recurring theme in bilateral relations, particularly since the UK’s decision to leave the European Union created new opportunities for independent trade negotiations.

Historical Context and Previous Negotiations

The path to a US-UK trade deal has been complicated by various factors:

- Prior to Brexit, the UK was part of the Transatlantic Trade and Investment Partnership (TTIP) negotiations between the US and EU, which stalled in 2016 without reaching conclusion.

- After the Brexit referendum, both countries expressed interest in a bilateral deal, with formal discussions beginning during the Trump administration’s first term.

- Despite multiple rounds of negotiations between 2020-2021, a comprehensive agreement was not reached before the change in US administration.

- Under the Biden administration, the US shifted focus away from new bilateral trade agreements, further delaying progress on a UK-US FTA.

Current Position of Trade Negotiations

The status of trade talks has evolved with changing political landscapes:

- Neither country currently has active comprehensive FTA negotiations underway, with the US generally moving away from large-scale trade agreements in recent years.

- Instead, both sides have pursued targeted sectoral agreements in specific areas like data, technology, and sustainable trade.

- The UK currently trades with the US without preferential terms, meaning goods and services face standard tariffs and non-tariff barriers that apply to countries without free trade agreements.

- Britain has free trade agreements with 71 countries, accounting for 64% of UK total trade, but the US—its largest trading partner—is notably absent from this list.

Future Outlook and Potential Scenarios

Several factors will influence the prospects for a future agreement:

- President Trump’s return to office brings renewed uncertainty, as his administration’s focus on bilateral deals and America-first policies could either accelerate or complicate negotiations.

- The statistical disagreement over trade balances may affect negotiations, with the UK likely to continue emphasizing US data showing an American surplus to avoid potential tariffs.

- Any agreement would need to address key sticking points from previous negotiations, including agricultural standards, pharmaceutical pricing, and digital services taxation.

- UK businesses have indicated the sectors that would benefit most from reduced trade barriers include machinery and transport equipment (currently £27.2 billion in exports), pharmaceuticals (£8.8 billion), and financial services (£28.6 billion).

A full free trade agreement remains a theoretical goal for both countries, but practical progress in the near term is more likely to come through targeted sector-specific agreements rather than a comprehensive deal.

The emphasis on “working out” trade issues mentioned in Trump’s recent statements suggests a transactional approach rather than a commitment to a full FTA in the immediate future.

Conclusion: The Future of US-UK Trade Relations

The trade relationship between the United States and the United Kingdom stands at a crossroads, shaped by shifting political landscapes, statistical disagreements, and evolving economic priorities on both sides of the Atlantic. Looking ahead, several key factors will influence how this crucial economic partnership develops.

Key Factors Influencing Future Trade

The trajectory of US-UK trade will be determined by multiple interrelated elements:

- The implementation of Trump’s tariff policies will be the most immediate factor affecting trade flows, with UK officials working to position Britain favorably by highlighting US data showing an American surplus.

- Brexit continues to reshape UK trade patterns, with Britain seeking to diversify its trading relationships beyond Europe while maintaining strong ties with traditional partners like the US.

- Sectoral strengths in services (particularly financial services and business consulting) will likely remain the backbone of UK exports to the US, while energy products and machinery continue to dominate US exports to Britain.

- Statistical alignment efforts between the ONS and BEA could eventually produce more consistent trade data, potentially affecting perceptions of the trade relationship’s balance.

Opportunities and Challenges Ahead

Both opportunities and risks exist in the evolving trade landscape:

- The UK’s financial services sector exported £28.6 billion to the US in 2023, representing almost a third (31.2%) of the UK’s total financial services exports worldwide, indicating potential for further growth in this area.

- Digital services and technology represent expanding areas for both economies, with UK telecommunications, computer, and information services exports to the US growing by 7.2% to reach £10.3 billion in the year to Q3 2024.

- Potential challenges include navigating regulatory differences in areas like pharmaceuticals, agriculture, and data protection that have historically complicated trade negotiations.

- The broader economic environment, including inflation rates, interest rate policies, and currency valuations, will influence trade flows independently of direct trade policies.

The economic relationship between these two major economies extends far beyond trade statistics, encompassing deep investment ties as well.

In 2023, the UK had £494.1 billion in outward foreign direct investment in the US (26.7% of total UK outward FDI), while the US had £708.1 billion invested in the UK (34.1% of total UK inward FDI).

Despite periodic tensions and policy differences, the fundamental interconnectedness of the US and UK economies suggests the relationship will remain resilient. The coming years will likely see pragmatic adjustments rather than radical reorientations, as both countries navigate the complex balance of protecting domestic interests while maintaining the benefits of their deep economic partnership.